If you want to apply for a home loan You must know what the appraisal price or home appraisal price is in order to prepare for applying for a loan to buy a house or condo, including various real estate properties in Thailand, and today Sun Gateway will reveal the secrets that Allows you to choose to buy a house or condo that will help you get a high appraisal price as well

Click to read according to the topic of interest.

What is a home appraisal?

The appraisal price is not the purchase price of the house.

What does the bank assess the house price from?

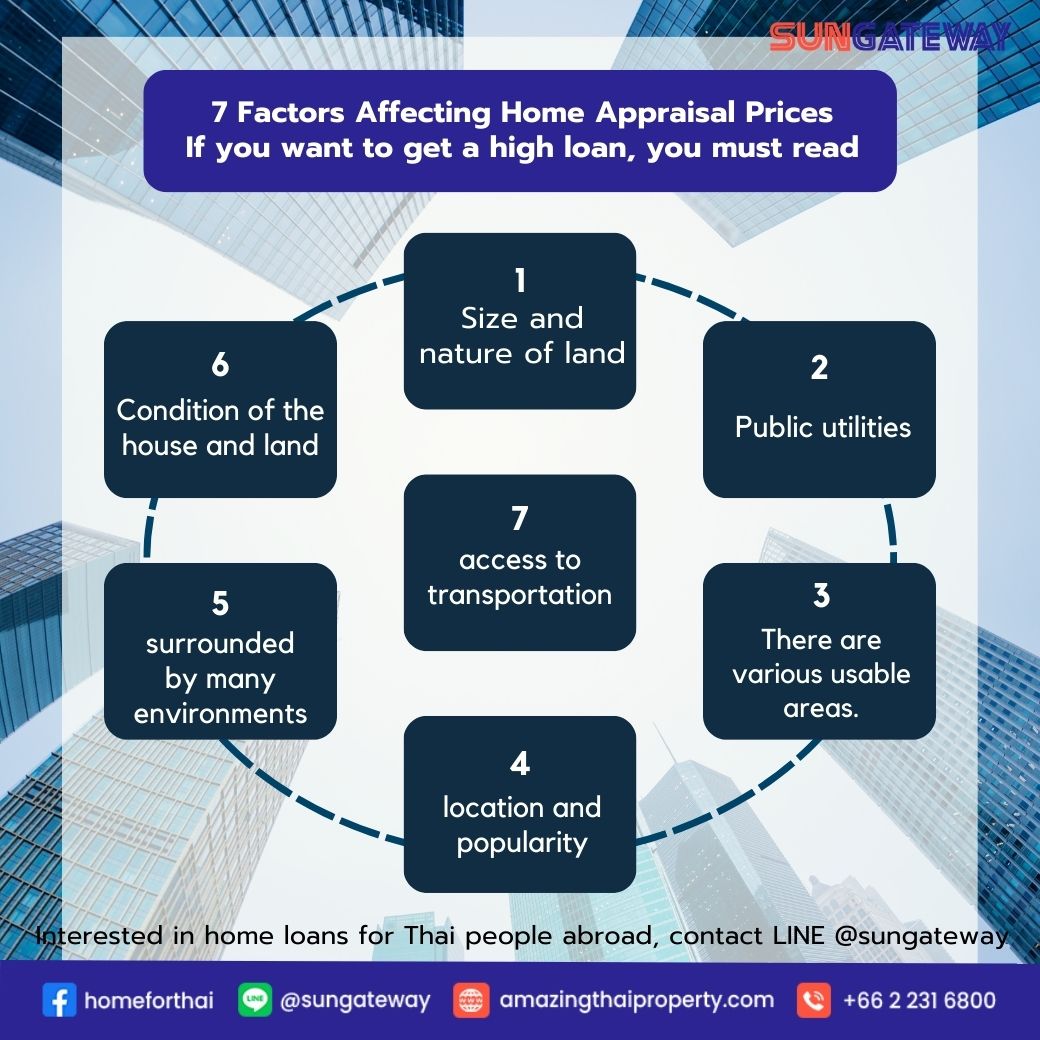

7 Factors Affecting Home Appraisal Prices

Where can I see home appraisals online?

Summary of home appraisal prices

What is a home appraisal price?

Appraisal price or home appraisal price is the median price evaluated by experts who have evaluated how much this house is worth. Which will not be the selling price that the seller has set. Many of you will be confused that the selling price is the amount that can be loan. But in fact, considering the home loan limit to the loan The bank will consider the appraisal price of that house.

The appraisal price is not the purchase price of the house.

I believe that many of you do not know that the bank will give you a loan to buy a house based on the appraised value. not selling price in general, the appraisal price of the house is usually lower than the actual selling price, however, it must be calculated from the maximum loan amount as well, for example, a maximum loan of 95%, and the remaining amount of the difference, the loan applicant must be issued himself, so important things In applying for a home loan, there must be a lump sum to be used as a difference in applying for a loan, sure enough.

For example

The seller sells the house for 2,300,000 baht.

The bank appraised the house at 2,000,000 baht.

And let the loan amount to 95% equal to be able to loan 1,900,000 baht

Therefore, the loan must pay the difference in the amount of 400,000 baht.

What does the bank assess the house price from?

As for the criteria that the bank will use to assess the price of a house, there are quite a number of factors. Basically, there are 3 criteria:

1. Appraised value of the Treasury Department

The Treasury Department’s appraised value is the middle price appraised by the Treasury Department. The agency is responsible for protecting the property of the land and many others. The Treasury Department also determines the appraised value of immovable property according to the Land Code. This includes buildings as well.

2. Market price and location of the property

The market price definitely affects the valuation of banks. The market price means The price of the same type of property in the same neighborhood or location.

3. Other additional factors

In valuing a house, the bank also has to use several additional factors to determine the value of the house for the loan. which is considered an important factor in the evaluation quite a bit Therefore, if you want to buy a house, buy a condo, it is recommended that you have to look at these factors first. For example, factors in assessing a house.

- Characteristics of the house

- Size of the house and land

- the age of the house

- house structure

- condition of the house

If the appraisal price is high The loan amount will be higher. But if the bank has a low appraisal of the house, the maximum credit limit will be less.

7 Factors Affecting Home Appraisal Prices If you want to loan high, you must read.

- Good Land has won more than half. The size and nature of the land definitely affect the appraised value. The land is likely to get a good appraisal price. It will look wide. square

- The condition of the house must be ready to live. The condition of the house and the land must be in new condition ready for use. If it is damaged, it is best to improve before submitting a loan.

- Convenient transportation access The matter of transportation is an important thing that many people tend to overlook, but did you know that if you want to get a high loan, you should find a house with convenient transportation, roads, and no obstacles to get out of the area? Good access to public transport The closer to the BTS or road expansion, the better the appraisal price.

- complete utilities Some of you may not know that if your house does not have access to water or electricity. The bank will greatly underestimate the price. Therefore, should make the water supply and electricity system accessible, it will help increase the appraisal price.

- surrounded by many environments Another factor that will make you get a high loan is the environment around the house. Or land, all affect the appraisal price, whether it is a park, community, or important places such as government offices, hospitals, schools, markets, or department stores. If the house has all these things, it will get a higher appraisal price than the house that is lacking from the environment, sure enough.

- location and popularity It is an important factor that will greatly affect the appraisal price. If the house is in a good location, the assessment price, which is good at home, often has various factors.

- There are various usable areas. Houses and lands where usable areas are often taken into account, such as gardens, farms, ponds, parking lots, etc.

Where can I see home appraisals online?

At present, you can view online home appraisal prices via the Treasury Department’s website, which has been prepared to serve the public, including officials, to see the median price of real estate throughout Thailand. You can choose to see the appraisal price in 3 types:

- vacant land

- Condominium buildings such as apartments, condominiums, etc.

- Buildings such as single houses, townhouses, commercial buildings, etc.

You can be viewed at the website https://assessprice.treasury.go.th/

Summary of home appraisal prices How important is it to apply for a home loan?

The home appraisal price of the house is not equal to the selling price of the house, but the price that experts have evaluated using various factors such as location, condition of the house, and surrounding environment. Public utilities, transportation, and many more. Which factors have a good effect on the home appraisal price can also help in deciding to buy a house, buy a condo, or land as well, so if the appraisal price is high The loan amount that the person applying for the loan will also be higher. However, the appraised value is always lower than the selling price. Therefore, the applicant should have a lump sum prepared as a difference in loans as well.